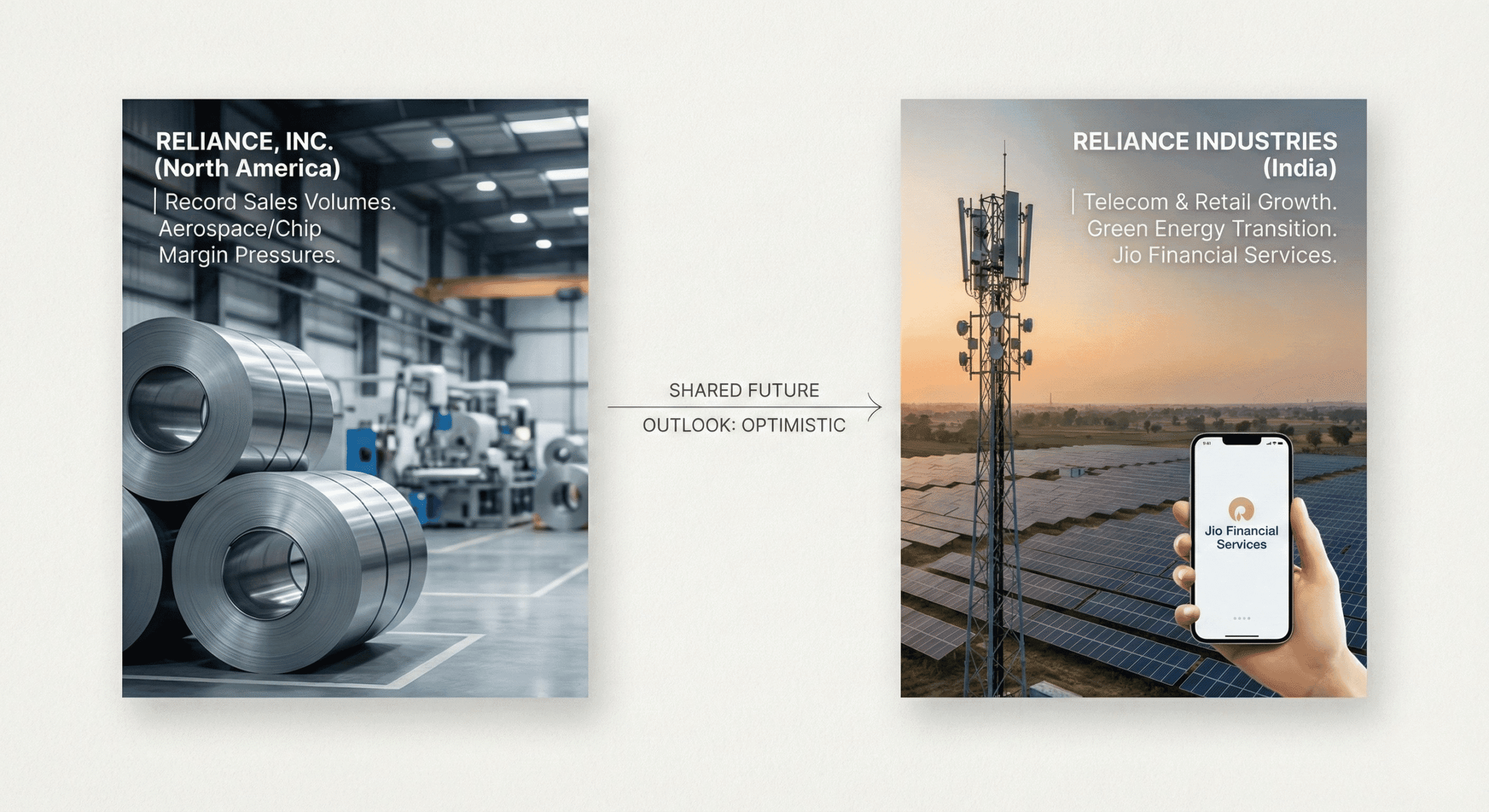

I used to look at Reliance Industries and just see a balance sheet. A massive, slightly boring monolith that grew simply because it was too big to fail. I was wrong.

If you spend enough time digging through their earnings calls—past the glossy headlines and into the gritty operational details—you start to realize something. They aren’t just bullying their way to growth; they are outsmarting the room.

While the market obsesses over their subscriber counts, Reliance is pulling levers in the background that most people miss entirely. I found four specific moves that prove this isn’t just a conglomerate; it’s a sniper in a field of shotgunners.

Here is what I found.

1. Everyone is Looking at the Clouds. Reliance is Winning in the Dirt.

If you ask any analyst where Reliance’s future lies, they’ll point to the digital cloud or green energy. They aren’t wrong, but they’re missing the cash cow standing right in front of them.

Jio-bp. The retail fuel business.

It sounds almost archaic, doesn’t it? Betting on petrol pumps in 2026. But look at the numbers. In a recent quarter, while competitors were fighting for scraps, Jio-bp posted volume growth of 34% in diesel and nearly 40% in gasoline. That is absurd.

I remember driving past a Jio-bp station last week. It wasn’t just a pump; it was an ecosystem. They aren’t just selling gas; they are selling “Active Technology” fuel and running lucky draws that feel more like a lottery than a marketing campaign.

Why does this matter? Because it proves they can take a mature, dusty industry—one that everyone says is dying—and squeeze double-digit growth out of it. It’s gritty, unsexy, and incredibly profitable.

2. The “Unsexy” Tech That’s Actually Connecting India

5G is the buzzword. It’s what sells phones. But if you talk to the network engineers—the guys actually climbing the towers—they’ll tell you 5G isn’t the silver bullet for home broadband. It has capacity limits.

So, what is Jio doing? They are betting on UBR (Unlicensed Band Radio).

I know, “Unlicensed Band Radio” sounds like something you’d find in a ham radio manual. But it’s the secret sauce. While everyone else is trying to force 5G to do the heavy lifting for home internet, Jio is using UBR to beam gigabit speeds through the air without laying a single inch of fiber.

It’s cheaper. It’s faster to deploy. And frankly, it’s genius.

Executives are claiming speeds up to 2.5 Gbps on the field. I’ve seen some of these setups; they are connecting millions of homes that fiber would take a decade to reach. This isn’t just “telecom.” This is deep tech engineering masquerading as a utility provider.

3. The “Self-Eating Watermelon” Strategy

I call this the “Self-Eating Watermelon” because the logic is circular—in the best possible way.

Reliance’s plan for New Energy is staggering: convert sand into solar panels. But here is the kicker. They aren’t just building these massive giga-factories to sell panels to you and me.

First, they are going to sell the energy to themselves.

Think about it. The Reliance Group is a power-hungry beast. By using their own solar panels and batteries to power their own refineries and telecom towers, they cut their internal energy bill by 25%.

That is billions of dollars in savings.

Those savings then fund the expansion of the factory, which produces more panels, which saves more money. It’s a perpetual motion machine of capital. Once the risk is gone and the machine is humming, then they bring in outside investors. It’s not just a business; it’s a self-funding fortress.

4. The Velvet Rope IPO

If you have a company valued at $180 billion, you sell a chunk of it and cash out, right?

Not if you are Reliance.

The rumor on the street is that when Jio finally IPOs in 2026, they might only float 2.5% of the company.

That is tiny. It’s crumbs.

But that’s the point. It’s the “Velvet Rope” strategy. By creating artificial scarcity, they drive the demand—and the valuation—through the roof. It creates pricing tension. If you want in, you have to pay the premium.

Most companies beg for capital. Reliance is making the market beg for shares. It’s a flex that only a company of this size can pull off, and it tells me they aren’t worried about cash—they are worried about control and prestige.

So, What Now?

Reliance is often painted as a brute-force operator. But these four moves show a different side: a company that is calculating, efficient, and willing to play the long game while everyone else is chasing the next quarter.

They are winning in the dirt with fuel, winning in the air with UBR, and winning in the boardroom with their IPO math.

Don’t bet against the house.