Most industrial conglomerates are dinosaurs. They roam the market looking for single-digit growth, tweaking efficiency margins until there’s nothing left to squeeze. It’s usually a slow, predictable decline. But Tube Investments of India (TIINDIA) isn’t playing that game. They aren’t just tweaking the machine; they’re rebuilding the engine while driving down the highway at a hundred miles an hour.

I’ve spent years analyzing industrial balance sheets, and usually, they put me to sleep. TIINDIA is different. When I first looked at their capital allocation structure, it didn’t look like a manufacturing plant. It looked like a Wall Street trading desk.

They’ve stopped acting like a factory. They’re acting like a predator.

The “TI Way”: A Hedge Fund in Factory Clothing

Forget “synergy.” Forget “optimizing workflows.” TIINDIA has built a capital allocation machine that fundamentally changes how they make money. They call it “TI-1, TI-2, TI-3,” but let’s cut through the jargon. It’s a three-stage rocket.

Bucket 1: The Cash Cow (TI-1) This is the boring stuff. Engineering. Metal forming. Cycles. It’s the unglamorous bedrock that keeps the lights on. But here’s the trick: they don’t pump money back into it. They milk it. These mature businesses churn out INR 8-9 billion annually. Reliable. Steady. Unexciting.

Bucket 2: The Venture Bets (TI-2) Most companies would take that cash and buy back stock. TIINDIA takes INR 2 billion of it—every single year—and throws it at wild, high-risk startups inside their own walls. Electric tractors. Optic lenses. Truck body building. It’s internal venture capital. Are all of them going to work? No. That’s the point. They only need one or two to hit big.

Bucket 3: The Distressed Asset Play (TI-3) This is where it gets aggressive. They use the balance sheet muscle from Bucket 1 to buy broken companies. Stressed assets. Things nobody else wants to touch. Then, they fix them.

It’s not just diversification. It’s an ecosystem. The old guards pay for the new experiments, and the failures are just a rounding error.

The 16x Gamble: The CG Power Story

I remember when they announced the acquisition of CG Power in late 2020. The market was skeptical. Why buy a company that’s bleeding cash?

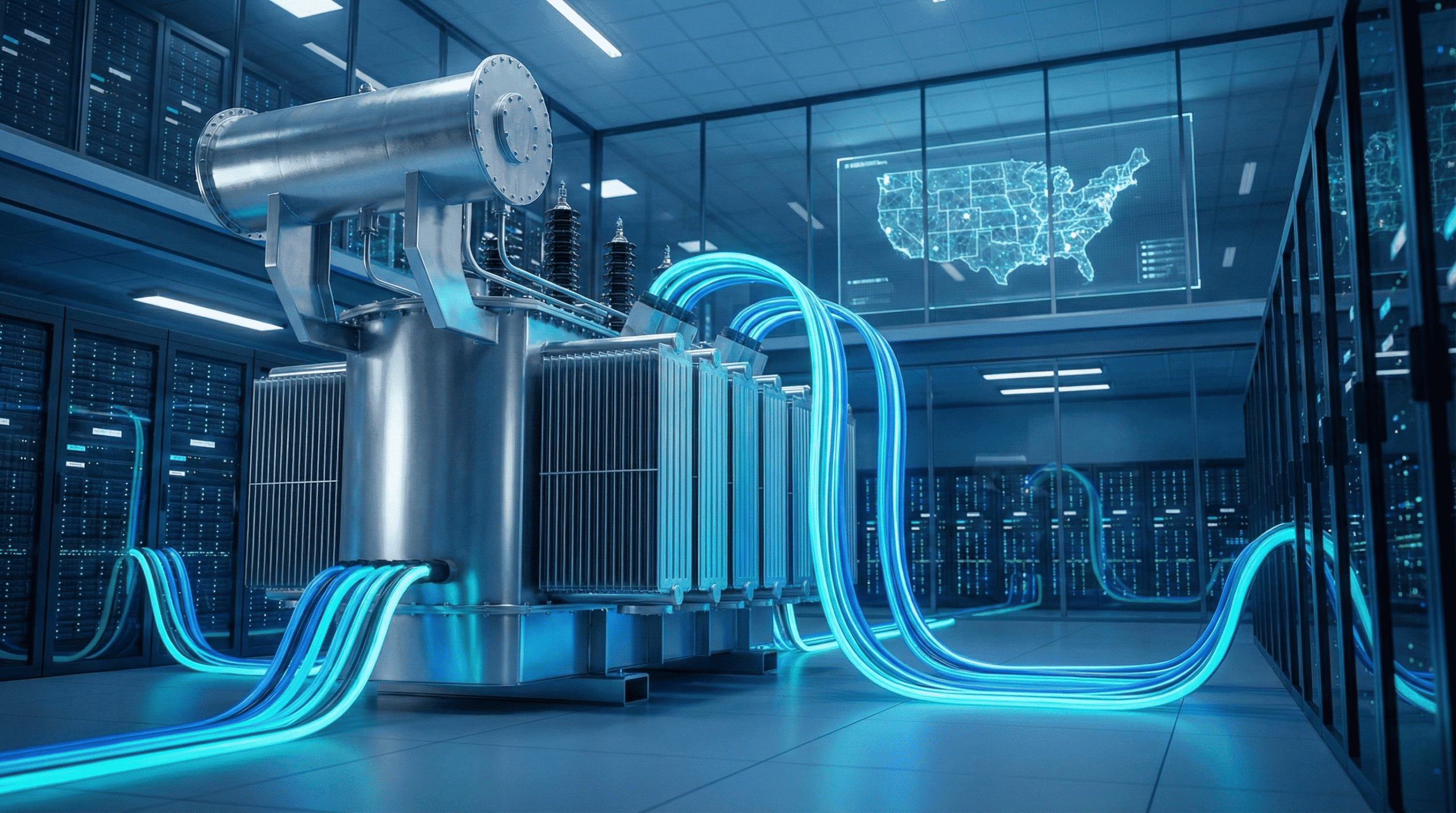

CG Power was a wreck. It was drowning in debt, posting a pre-tax loss of INR 1.16 billion. It looked like a money pit. But TIINDIA saw something the rest of us missed. They grabbed a 58.6% stake for an implied market cap of INR 13.7 billion.

Then, they went to work.

The turnaround wasn’t just fast; it was blistering. Within a fiscal year, that INR 1.16 billion loss flipped into an INR 5.3 billion profit. The valuation didn’t just tick up. It exploded.

Today? CG Power’s market cap sits at INR 232 billion. That is a 16x return.

In my time covering M&A deals, I’ve seen plenty of “turnarounds” that turned into dead ends. This was different. This was forensic. They stripped the asset down, fixed the core, and unleashed value that was invisible to the naked eye. It proved the TI-3 model isn’t just a slide in a PowerPoint deck. It prints money.

The 25% “War Cry”

Here is where the audacity kicks in.

Most legacy companies are happy to beat inflation. TIINDIA’s boss, Vellayan Subbiah, has slapped a target on the wall that sounds borderline delusional for a manufacturer: 25% profit growth. Every. Single. Year.

And they aren’t going to get there selling more bike chains.

They’ve done the math. The core business (TI-1) will struggle to drag them past 8-10%. The other 15-17%? That has to come from the moonshots (TI-2) and the distressed buyouts (TI-3). It’s a public declaration of war against stagnation. They are effectively saying, “We will not be an auto-parts supplier. We will be a growth monster.”

So, What’s the Catch?

Is this the holy grail? Maybe.

But executing this requires a level of discipline that most boardrooms lack. You have to be willing to let the cash cow starve a little to feed the calf. You have to be willing to buy ugly assets when everyone else is buying AI stocks.

TIINDIA is running a masterclass in corporate evolution. They aren’t waiting for the future to happen to them; they are buying it, piece by distressed piece.

The question isn’t whether the model works—the 16x return on CG Power settled that debate. The question is: Who else has the guts to copy them?