Forget the caricature.

You know the one. The ruthless, vest-wearing hedge fund manager obsessed with quarterly earnings and nothing else. It’s a tired trope. And honestly? It’s boring.

Mala Gaonkar isn’t just ignoring that stereotype; she’s taking a sledgehammer to it.

I’ve spent years tracking the movers and shakers of high finance, and usually, the “interesting” part of their bio is a vineyard in Napa or a vintage car collection. Gaonkar is different. She operates at this weird, electric intersection of algorithmic trading, immersive theater, and gritty, boots-on-the-ground philanthropy. It doesn’t make sense on paper. But in practice? It works.

Here are five reasons why she is currently the most fascinating anomaly on Wall Street.

1. She Didn’t Just “Enter” the Room. She Kicked the Door Down.

January 3, 2023.

While the rest of the market was still nursing a collective hangover from a brutal previous year, Gaonkar was busy making history. She launched SurgoCap Partners with $1.8 billion in assets.

That number isn’t a typo.

In my experience covering fund launches, a “good” debut is maybe a few hundred million. $1.8 billion? That’s not a launch; that’s a gravitational event. It stands as the largest debut for a woman-led hedge fund in history. But she didn’t come out of nowhere. She spent 23 years sharpening her teeth at Lone Pine Capital, one of the industry’s titans. She didn’t ask for a seat at the table. She built her own table.

2. The Growth Curve Is Vertical

If you thought the launch was loud, the follow-up was deafening.

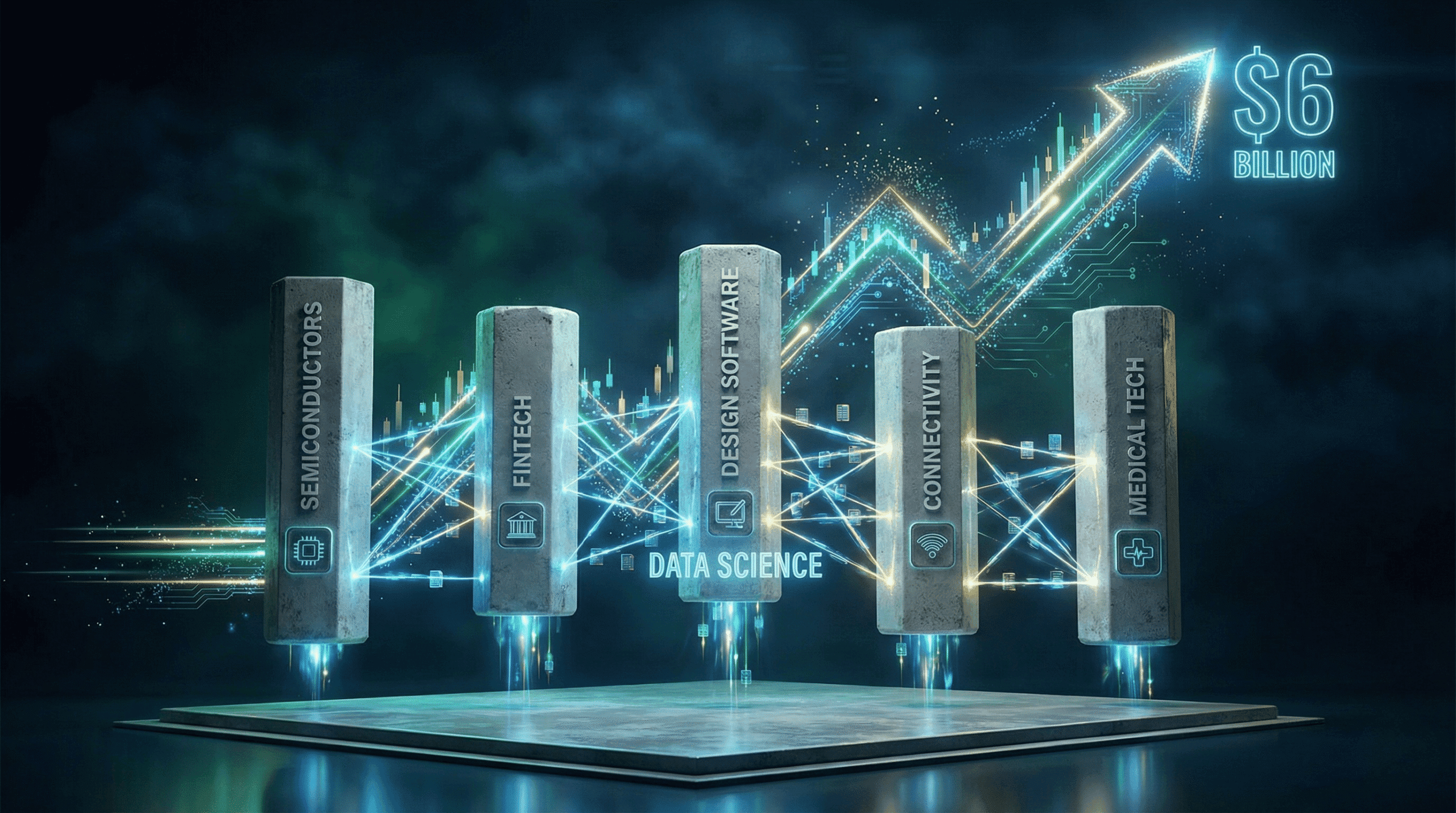

Most funds spend years trying to crawl their way up. SurgoCap just… sprinted. Within a year, assets hit $3 billion. By early 2026? We’re looking at $6 billion.

That is blistering speed.

I’ve seen funds blow up trying to grow that fast. They get sloppy. They chase bad deals. But Gaonkar is playing a different game. Her strategy is heavily data-centric, betting on how tech acts as a force multiplier for other sectors. We’re talking about a portfolio that holds the usual suspects like Nvidia, sure, but also plays in the messy, complex worlds of healthcare (McKesson) and energy (GE Vernova).

She’s not just buying stocks. She’s buying the infrastructure of the future.

3. She Co-Created a Theater Piece. (Yes, Really.)

This is where the story goes off the rails.

Usually, when a financier mentions “art,” they mean they bought a painting to stick in a climate-controlled vault. Gaonkar? She co-wrote a play with David Byrne.

The David Byrne. From Talking Heads.

It was called Theater of the Mind, a deeply immersive, neuroscience-based experience that messed with your perception of reality. I caught wind of this and thought, why? Why would a data-obsessed investor spend time on experimental theater?

Because it’s the same muscle.

To write a story that hacks the human brain, you have to understand behavior. To beat the market, you have to understand behavior. It’s all pattern recognition. She’s also a Pushcart-nominated fiction writer, by the way. Just in case you thought she wasn’t busy enough.

4. The “One Pizza Box” Rule

Jeff Bezos made the “two-pizza rule” famous. If a team can’t be fed by two pizzas, it’s too big.

Gaonkar looked at that and said, “Cut it in half.”

She runs a $6 billion empire, yet she insists on a team small enough to fit around one table—or share a single pizza. On the In Good Company podcast, she broke it down. She believes that massive teams dilute the “intellectual voltage.”

“The smaller team is so fruitful for new idea generation,” she said. “There is something about human collaboration that works best on a smaller scale.”

I love this. In a corporate world that loves to bloat, adding VP after VP until nothing gets done, keeping it lean is a radical act. It cuts the fat. It kills the bureaucracy. It keeps the hunger alive.

5. Data Science That Actually Saves Lives

Let’s be honest. “Philanthropy” in finance often means writing a check to a museum and posing for a photo.

Gaonkar’s approach is different. It’s nerdy, rigorous, and actually effective.

She co-founded the Surgo Foundation (now part of SurgoCap’s broader mission) to use AI and data to solve unglamorous problems—like sanitation in India. It’s not sexy work. It’s hard, messy, logistical work. But she applies the same cold, hard analytical models she uses to evaluate tech stocks to figure out why people aren’t getting clean water.

And she’s putting her money where her mouth is. SurgoCap has earmarked $100 million specifically for underserved communities and climate issues. Not as a PR stunt, but as a core part of the thesis.

The Bottom Line

Mala Gaonkar is a Rorschach test for the industry.

Some see a brilliant investor. Others see an eccentric artist. I see someone who realized that the walls we build between “finance,” “art,” and “social good” are imaginary.

She’s using the profits from one to fuel the insights of the other. It’s a feedback loop of money, creativity, and data. And as she continues to scale that vertical cliff of success, you have to wonder:

If this is what she did in three years, what the hell does the next decade look like?